The news is full of clips about the housing market, home appreciation, and inflation. The media tends to have a very doom and gloom take on the situation, but is that accurate? When it comes to home appreciation and inflation, which will increase more? With it being a time of increased inflation and potentially a recession in the near future, is now a safe time to buy or sell a home? These are all great questions that are important to ask yourself! After all, many people still have PTSD about the housing market. However, is our PTSD from the past causing us to make poor choices for our future? In many cases, the answer is “Yes” and that is especially true when it comes to weighing home appreciation vs. inflation.

Is Real Estate a Good Investment In Times of High Inflation?

Right now, inflation is inching up to the highest level in the last 40 years. In 2021 inflation went up 7% which was the highest 1 year jump since 1982. Real Estate history has proved that the 80s were not great for interest rates and consequently real estate sales. However, when it comes to inflation itself, (we will discuss interest rates more next week) historically speaking, real estate has always done well during times of inflation. That is because home appreciation outpaces inflation year after year.

The main benefit of owning a home during inflation is that when you lock into a fixed-rate mortgage your payments will remain fairly steady. There will be increases due to property taxes going up, but that is typically minimal. Therefore, even though the prices of goods and services continue to rise, your mortgage doesn’t. Renters in particular will feel the strains of inflation because, unlike fixed-rate mortgages, rent tends to increase right along with inflation.

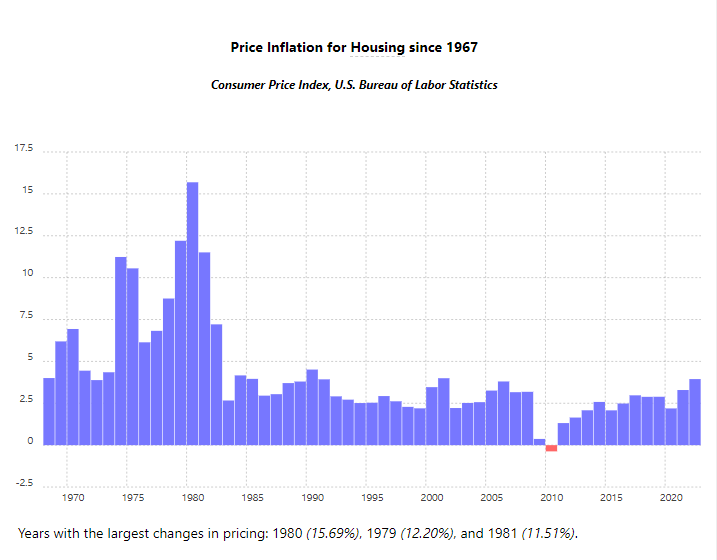

Here is a chart showing home appreciation levels since 1967. Notice how the only time that home values fell was in 2010. Housing is always a strong investment. Especially when it comes to long term investments. Even if you pay a ridiculous amount over what a home is worth, in 20 years, you will look back and be happy you bought when you did.

Historically the average annual home appreciation is 4.17% and the average inflation rate since 1967 is 3.97%. Home appreciation beats inflation by a hair.

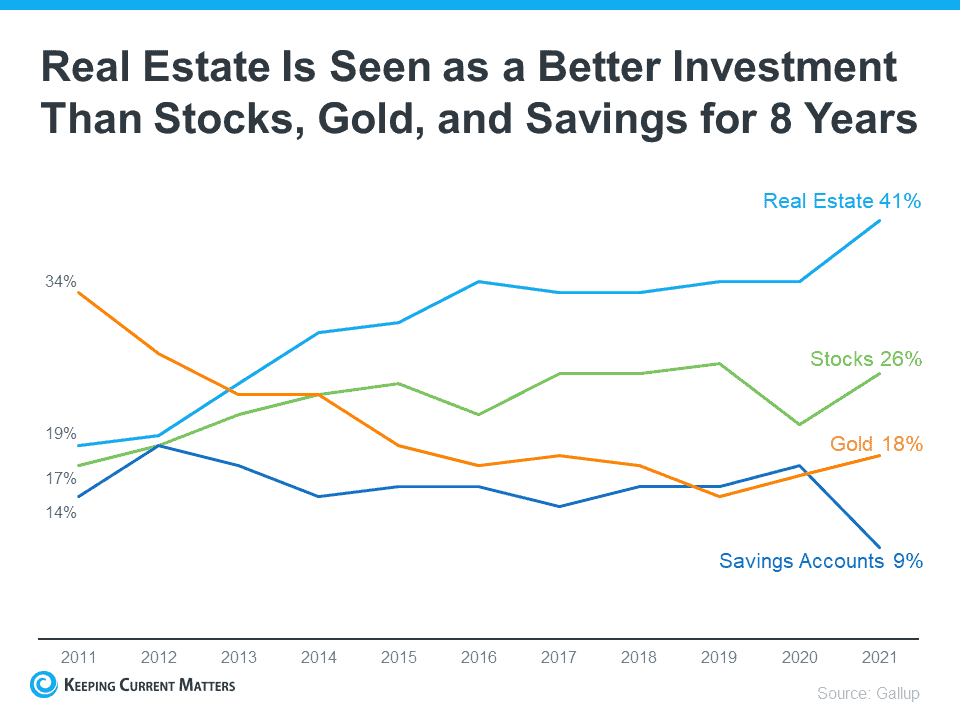

According to an annual Gallup poll, Real Estate is considered by Americans to be the best investment for the last 8 years in a row.

Home Appreciation vs. Inflation – Who will be the winner?

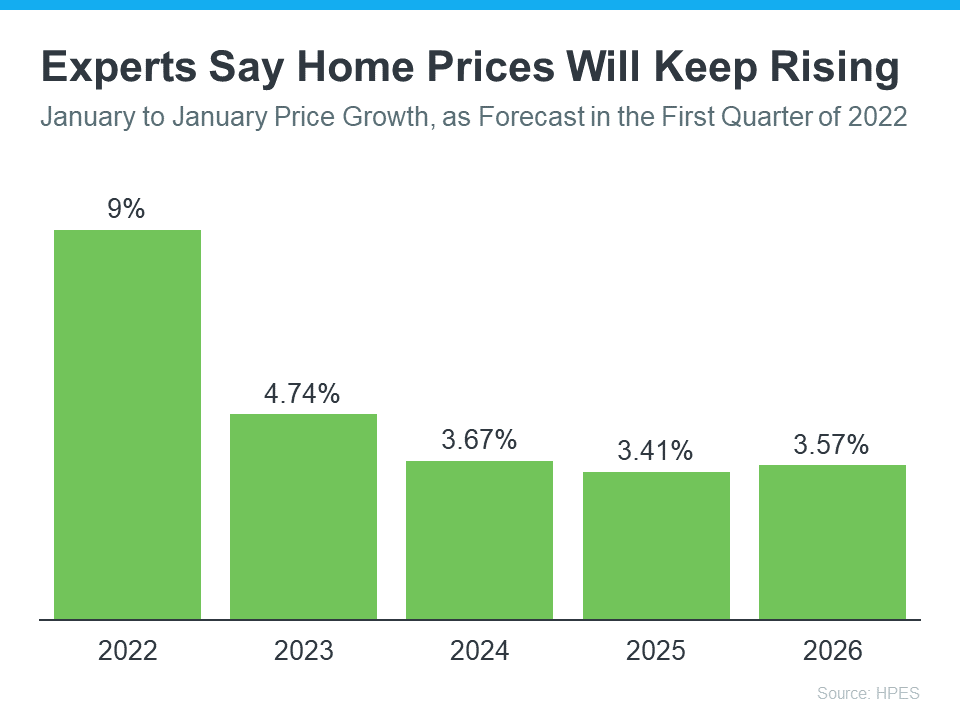

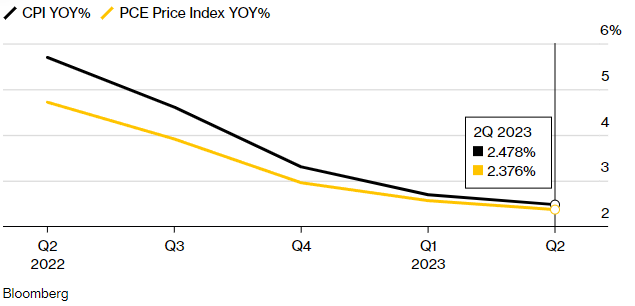

Look at this chart of expected home appreciation over the next 5 years. There is also a chart showing expected inflation for 2022 and 2023.

As you can see, home appreciation beats inflation. This is one of the main reasons that buying investment properties is so lucrative and a staple of all wealthy business pioneers. We will get into that more another time though.

Take away

Without a doubt, historically buying a home has been a key to building wealth and creating the American dream. It has also been a much better option than not buying a home. I can tell you so many stories of people who decided to wait to buy a home and regretted that choice. However, there have been some people who regretted buying as well. The people who regretted not buying did so because of the financial loss. the people who regretted buying usually did so because of a situational change that they weren’t expecting, i.e. divorce or change of job. Financially speaking it is almost always better to buy than it is to wait. Think of how nice things would be if you had chosen to buy in early or mid 2020! However, I am not a financial planner and don’t know your personal finances. Before you commit to such a large purchase, it is always best to talk to your financial planner and lender to see if buying a home makes sense for you!

Sorry, I know it was a lot of charts today, but thanks for reading!

Ginny Krauss

Kelly Marion

Published on 2022-12-07 07:58:20

© 2025 Cheryl Clossick — Real Estate One. All Rights Reserved.

© 2025 Cheryl Clossick — Real Estate One. All Rights Reserved.