A couple of months ago, the National Association of REALTORS announced that we are in a housing recession. No surprise there. With all of the economic and housing market uncertainty, many people are asking, “Is this housing recession like 2008?” The answer is a solid “No.” Here are 3 reasons why this housing recession is not like the housing recession of 2008 and some charts to back it up.

It is still a seller’s market

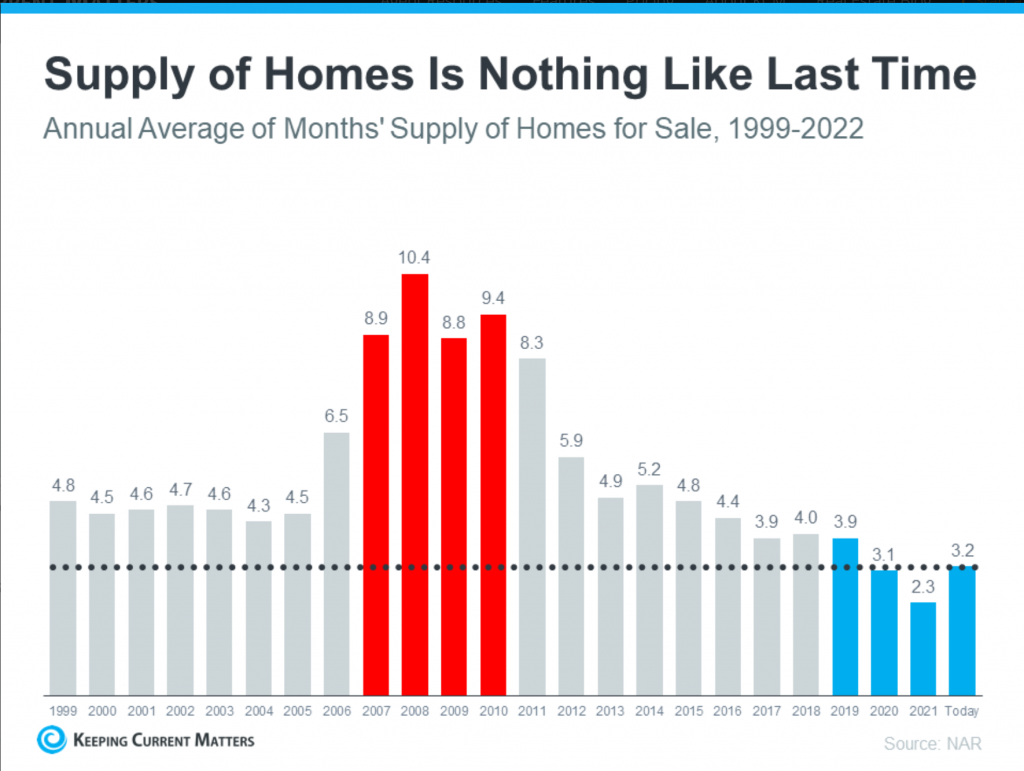

It is considered to be a seller’s market if there is less than a 6 month supply of homes. What does that mean? The month supply is based on how long it would take for every current buyer to buy up the entire housing inventory if no more homes were to come onto the market. Right now there is a 3.2 month supply. This is technically different than the average sale time for homes, but they often go hand in hand. Compared to everything that was happening with housing in 2020 and 2021, 3 months may seem like an eternity, but when you look at the big picture, you can see that it is still a short amount of time historically speaking. In 2008 we had a 10.4 month supply. Tight inventory is a big component of why we are only in a housing recession and not a housing crash.

Lending practices have changed

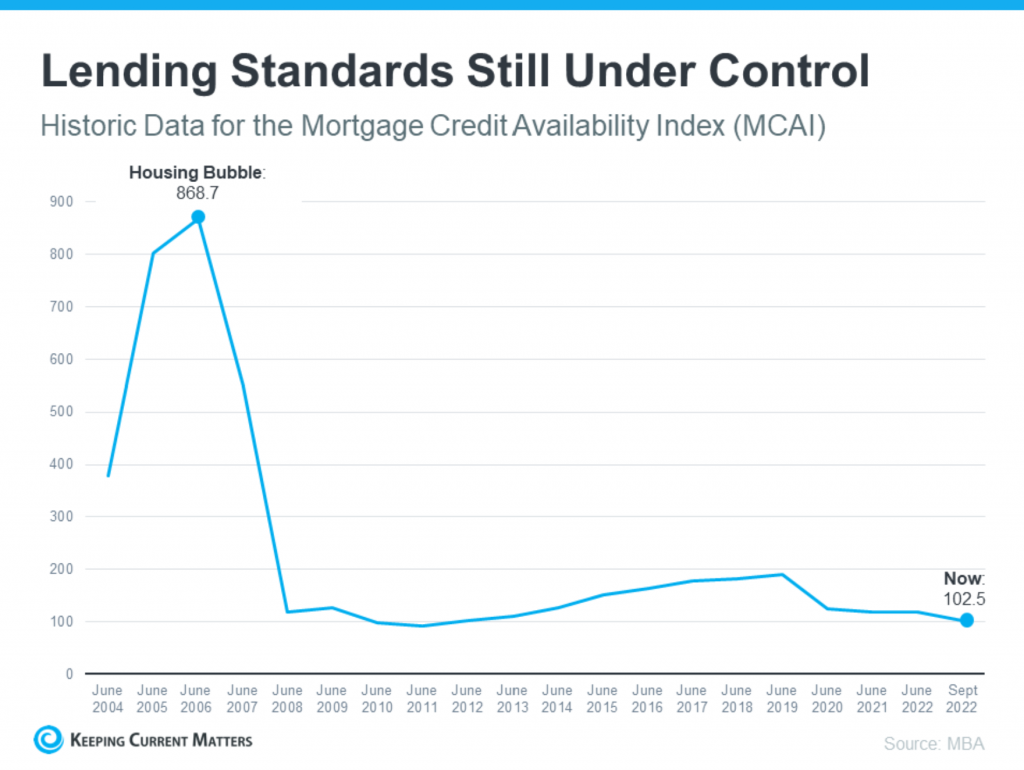

The mortgage industry has changed drastically since 2008. The federal government has put countless pieces of legislation in place to help ensure that a housing crash like the one in 2008 never happens again. Before then, mortgage lenders would give a loan to anyone with a heartbeat. The requirements for pre-qualification were very minimal. The trouble was compounded by predatory lending practices that created unsustainable loans for borrowers. The Mortgage Credit Availability Index is an index that shows how easy it is to get a mortgage. As you can see, and perhaps have experienced, it is much more difficult to get pre-approved for a loan now compared to 2008. In fact, right now is the most difficult it has been in a decade. These strict lending practices help to ensure that only the most qualified buyers get financing in order to avoid excessive foreclosures like we saw previously.

Fewer foreclosures

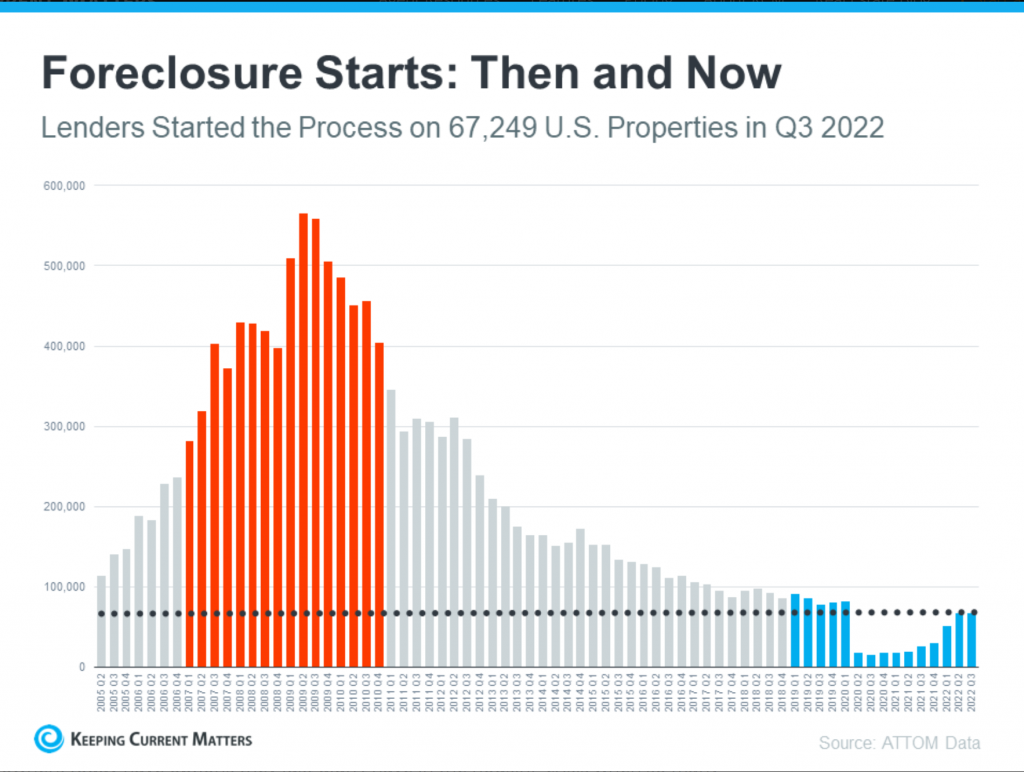

This last point actually ties into the first two points about the housing recession. In addition to the stricter lending practices to help prevent foreclosures, homeowners have also experienced a tremendous boost to the amount of equity that they have in their homes. This means that homeowners have more options and can sell their homes for a profit rather than losing everything to the bank. The average homeowner has just under $300,000 in equity according to the CoreLogic Home Equity Report. That is a record high. Now there are some cases where homes will still go into foreclosure, but the numbers are substantially less than before. The lack of foreclosures bombarding the market means that inventory will remain steady.

Outlook

Yes, we are in a housing recession, but it isn’t something to get too worked up about. Although September was slow, home sales seem to have remained steady this month in Saline. Think of this housing recession as an opportunity to start looking for some great real estate investments (especially with inflation and the stock market being the way they are right now). Real estate is always a good investment when properly researched. Take advantage and use it to help build your wealth.

As always, if you have any questions about the market, feel free to reach out to us. We’d be happy to answer your questions for you. You may also like our blog Home Appreciation vs. Inflation.

Thanks for reading!

Published on 2022-12-07 10:14:00

© 2025 Cheryl Clossick — Real Estate One. All Rights Reserved.

© 2025 Cheryl Clossick — Real Estate One. All Rights Reserved.